Understanding Wood Plastic Composite Decking Tariff Code for Importing

When it comes to importing wood plastic composite decking, one of the crucial aspects to consider is the tariff code assigned to these materials. This code not only determines the duties and taxes applicable to your imports but also plays a significant role in compliance with international trade regulations. Understanding the tariff code for wood plastic composite decking can help you navigate the complexities of importation, ensuring a smooth process from installation to maintenance.

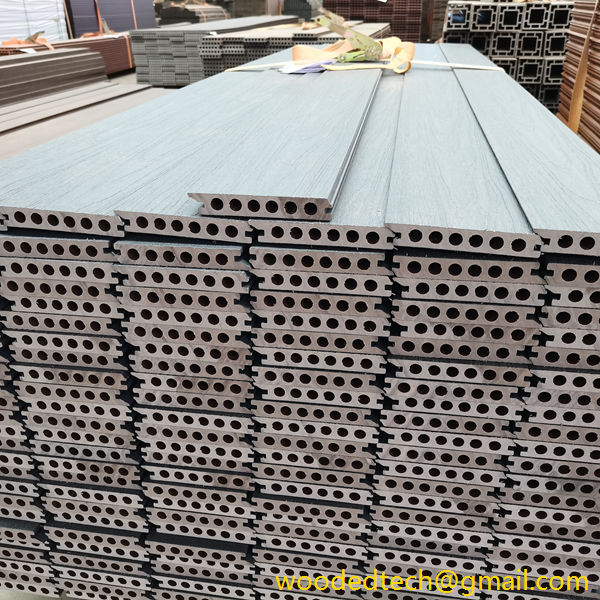

To begin with, it is essential to define what wood plastic composite decking is. This innovative material combines wood fibers and plastic to create a durable, weather-resistant product suitable for outdoor applications. The appeal of wood plastic composite decking lies in its aesthetic resemblance to traditional wood, coupled with enhanced durability and reduced maintenance requirements. As this material gains popularity, understanding the tariff code associated with it becomes increasingly important for importers.

The tariff code, often referred to as the Harmonized System (HS) code, is a standardized numerical method of classifying traded products. It is used globally to determine tariff rates and trade statistics. For wood plastic composite decking, the correct tariff code classification ensures that importers can calculate applicable duties accurately and comply with regulatory requirements when bringing their products into a new market.

To classify wood plastic composite decking correctly, importers must consider the composition and intended use of the product. Typically, wood plastic composite decking falls under a specific heading in the HS code system that relates to composite materials. This classification may vary depending on the percentage of wood fibers versus plastic in the composition, as well as the product’s form and application. Therefore, it is essential to consult the latest customs regulations and guidelines to identify the correct tariff code efficiently.

Once the appropriate tariff code has been established, importers can move forward with the process of shipping their products. It is vital to prepare all necessary documentation, including invoices and shipping manifests, that accurately reflect the nature of the goods being imported. This documentation should explicitly state the established tariff code to ensure that customs authorities can process the shipment without delays.

Beyond understanding the tariff code for importing, it is also important to consider the installation of wood plastic composite decking. Proper installation is crucial to maximize the lifespan and performance of the decking. Unlike traditional wood decking, wood plastic composite requires specific installation techniques to prevent issues such as warping or buckling. It is advisable to follow the manufacturer’s guidelines and recommendations for installation, including using the appropriate fasteners and spacing between boards.

Furthermore, as part of the maintenance process, wood plastic composite decking requires less upkeep compared to traditional wood. However, regular cleaning is still necessary to maintain its appearance and performance. Importers should educate their customers about proper maintenance practices, such as using mild soap and water for cleaning, avoiding harsh chemicals, and ensuring proper drainage to prevent moisture accumulation.

In addition to installation and maintenance, it is wise to keep abreast of any changes in regulations concerning wood plastic composite products. Tariff codes and import duties can evolve, influenced by factors such as trade agreements, environmental regulations, and market demand. Staying informed about these changes can help importers adapt their strategies accordingly, ensuring compliance and maximizing profitability.

Moreover, building strong relationships with suppliers and manufacturers can also provide valuable insights into the latest trends in wood plastic composite decking. This collaboration can lead to improved product offerings, enhanced customer satisfaction, and a competitive edge in the market.

In conclusion, understanding the tariff code for importing wood plastic composite decking is essential for importers aiming to navigate the complexities of international trade successfully. By classifying products accurately, complying with regulations, ensuring proper installation, and promoting effective maintenance practices, importers can enhance their operations and provide customers with high-quality decking solutions. Staying informed and adaptable in this dynamic market will ultimately contribute to long-term success in the wood plastic composite decking industry.