The Importance of WPC Decking Panel HS Code for Compliance and Import Regulations

Wood Plastic Composite, or WPC, decking panels have grown significantly in popularity due to their durability, aesthetic appeal, and sustainability. As manufacturers and importers engage in the production and distribution of WPC products, understanding and adhering to compliance and import regulations becomes crucial. One of the key elements in this regard is the Harmonized System code, commonly referred to as HS code. This standardized numerical method of classifying traded products is essential for ensuring compliance with international trade regulations.

The HS code plays a vital role in the import and export of WPC decking panels. This code helps customs authorities identify the product type, which in turn determines the applicable tariffs, taxes, and regulations that govern its importation. For manufacturers and importers, correctly classifying WPC decking panels under the appropriate HS code is necessary to avoid potential legal issues, fines, or delays in the supply chain. Misclassification can lead to significant financial losses and disruptions in business operations.

From a compliance perspective, using the correct HS code is essential for adhering to various environmental and safety regulations. Many countries have specific regulations governing the importation of composite materials, requiring that they meet certain standards for safety and environmental impact. For instance, WPC decking panels might need to comply with regulations concerning the use of recycled materials, chemical content, and emissions during production. By accurately categorizing these products under the correct HS code, manufacturers can ensure that they are meeting all required standards, thereby facilitating smoother importation processes.

In addition to compliance with safety and environmental regulations, the HS code also impacts the overall marketability of WPC decking panels. Different countries impose varying tariffs based on the product classification. For instance, if a WPC decking panel is classified under a higher tariff category due to misclassification, it may not be competitively priced compared to similar products. Therefore, understanding the intricacies of HS codes can provide manufacturers with a strategic advantage in international trade. This knowledge enables them to work closely with customs brokers and trade compliance experts to ensure their products are classified correctly.

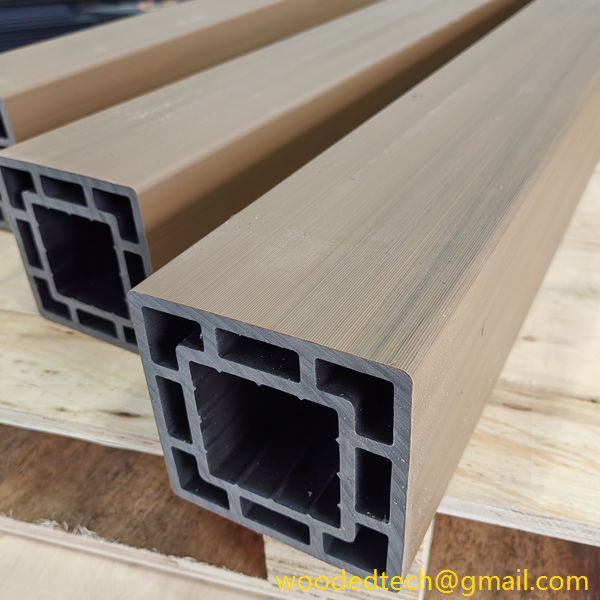

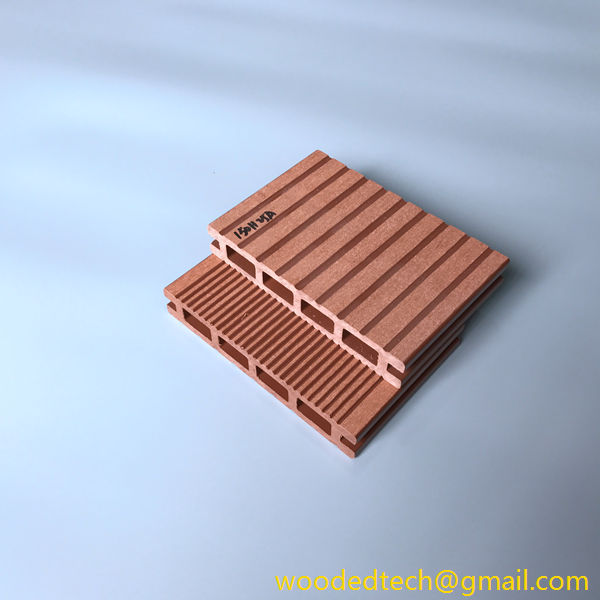

The production process of WPC decking panels involves a unique combination of wood fibers and plastic materials. This composite material is engineered to provide the benefits of both wood and plastic, including resistance to rot, splintering, and fading. However, the chemical composition of WPC materials can vary widely based on the specific manufacturing processes employed. Hence, it is crucial for manufacturers to document their production processes accurately and transparently. Such documentation can help in the proper classification of the product under an appropriate HS code, mitigating any risk of non-compliance during inspections by customs authorities.

Furthermore, as environmental concerns continue to rise globally, consumers are increasingly seeking sustainable building materials. The use of recycled plastics in WPC decking panels can significantly enhance their market appeal. However, to leverage this aspect effectively, manufacturers must ensure their products are classified correctly under the HS code that reflects their sustainable attributes. This classification not only helps in compliance but also in marketing the product as environmentally friendly, thereby attracting a broader customer base.

Moreover, with the rise of e-commerce and online marketplaces, the importance of HS codes has become even more pronounced. In many instances, online platforms require sellers to provide accurate HS codes for their products to facilitate seamless transactions and shipping. Manufacturers and importers must be diligent in ensuring that the HS code they use aligns with the product description and specifications. Failure to do so can result in delays, returns, or even penalties from the platform providers.

In conclusion, the significance of using the correct HS code for WPC decking panels cannot be overstated. It is a crucial factor in ensuring compliance with international trade regulations, facilitating smoother import processes, and enhancing the marketability of these products. By understanding the production processes and the characteristics of WPC materials, manufacturers can classify their products accurately, which will ultimately contribute to their success in the competitive global marketplace. As the demand for sustainable and durable building materials continues to grow, adhering to compliance and import regulations through accurate HS coding will be vital for manufacturers and importers alike.